The Rate Snapshot Happens June 1st

You probably know that every employer in Washington state must have workers’ comp coverage through the state’s Department of Labor and Industries (L&I). Even though you can’t shop around, this system does provide a big advantage. Since L&I is a public agency, we know exactly when rates are calculated, what numbers are used for the calculation, and how your company’s rates compare to others in your industry. Imagine trying to get that much detail from your car insurance provider!

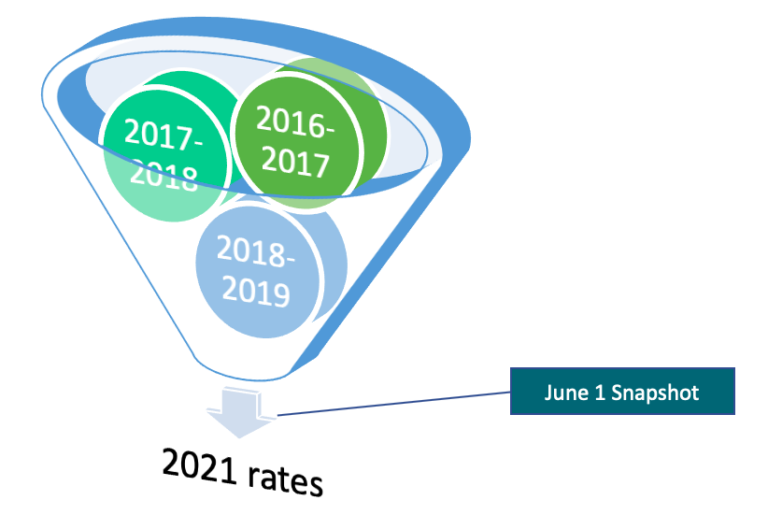

A big piece of the rates process happens next month, when L&I will take a “snapshot” of claims costs in order to set rates for 2021. The snapshot occurs annually, every June 1st for all employers in Washington State. At that time, L&I looks at all of its employer accounts and takes note of the total cost of claims on that day. Just like with car insurance, those costs are used to calculate your upcoming rates. And, also like car insurance, you may qualify for a discount if your costs are minimal or if you didn’t have any claims at all.

Are my L&I workers’ comp rates going up?

L&I will calculate your 2021 rates by looking at any workplace accidents which occurred in these three periods:

July 1, 2016 to June 30, 2017

July 1, 2017 to June 30, 2018

July 1, 2018 to June 30, 2019

Any costs associated with the workers’ comp claims – as of the snapshot day – will be used to calculate your experience modification rate for 2021.

As you can see, L&I looks back four years to set rates for the upcoming year. This means that a workplace accident in July 2016 can still cost your company money in December 2021. That’s more than 5 years after the accident! And, you pay these higher rates for every hour, every worker. This is why we offer free safety visits to help you update your Accident Prevention Plan. The cheapest claim by far is the one that never happens.

How can I lower my rates?

The best way to lower your rates is by returning your injured employees to work, i.e., offering light-duty. By doing so, we can then advocate for a reserve reduction, thereby reducing the costs and impact of those claims to rates. Talk with your Approach Retro Coordinator to find out more.

Will COVID-19 coronavirus affect my rates?

L&I has stated that employers will not be held liable for coronavirus claims, even if the claim is allowed. This means that a COVID-19 coronavirus claim will NOT impact:

- Workers’ comp rates

- Eligibility for the Claim-Free Discount

- Retro refunds

BUT, and it is a big but, the pandemic can still wreak havoc with your rates — for claims that have nothing to do with COVID-19! That’s because L&I is allowing time-loss to pay out for workers who don’t have a current light-duty assignment, even if it’s due to the stay-at-home order.

If you have any workers not currently working due to an L&I claim, it’s critical that you work with your Approach Retro Coordinator to develop a return-to-work plan as soon as possible. Time-loss often has more impact on rates than any other aspect of a claim.

When are workers’ comp rates announced?

Employers in Washington state will get estimated rates from L&I in the fall. In October and November, Approach will hold Brain Trusts to look at the highlights of rate setting for 2021. Rates will become final in December and effective in January 2021.

If you’d like a preliminary estimate, contact your Approach Retro Coordinator. We can develop an estimate for your company and help you strategize ways to lower the overall cost of claims.