Have you ever asked yourself how does “Kept on Salary” (KOS) save my company money? Or has management asked you to provide proof that KOS is the right thing to do?

You are not alone!

Employers who are new to Kept on Salary often have many questions about the costs and benefits. In many claims, this is one of the best tools available to employers to control claim costs, move claims to a positive resolution and reduce future increases to workers’ comp insurance rates. Additionally, in the vast majority of cases we have found that the savings experienced as a result of using this tool is greater than the cost to employers! Plus, your Approach Retro Coordinator can provide a custom calculation on how Kept-on-Salary can save you money in a specific claim.

Let us explain…

What is Kept on Salary?

When an injured worker is deemed unable to work by the medical provider (or when appropriate light duty is not available), L&I will usually issue time-loss payments to the worker. Employers have the option of continuing the injured worker’s wages instead – this process is called Kept on Salary, or KOS for short.

Bottomline: Workers are entitled to compensation during recovery from a workplace injury or occupational disease.

If L&I issues time-loss payments or loss of earning power (LEP) to the injured worker, those payments are charged to the employer’s account and are typically the most costly element in a workers’ compensation claim. KOS is your company’s opportunity to pay the worker directly, avoiding the financial impact of time-loss payments from L&I to your Experience Modification Rate (EMR) as well as to your company’s performance in Retro.

We recommend KOS as a strategy to both control claim costs and maintain overall control in a claim.

When does Kept on Salary begin?

Once the injured worker is certified as off work, which is usually communicated through an Activity Prescription Form from the medical provider, KOS should begin immediately. Do not begin KOS until the worker is certified off work. Approach recommends employers pay KOS for up to 30 days, or to the extent required in the participant agreement with your Retro association. Retro Coordinators at Approach can advise employers of the financial cost/benefit in instances where KOS may be recommended for an extended period.

Advantages of Kept on Salary over time-loss.

- More predictable for the worker – allows the worker to focus on recovery with confidence that wages will continue to be paid

- Reduces overall claim costs and can prevent “reserve,” or estimated future costs from being added to the claim

- Helps to reduce or prevent future rate increases due to claim costs

- Can help keep a claim “medical only” and preserve the Claim Free Discount earned by many employers

- Provides better control over the claim by allowing employer to maintain close contact with the worker and gain greater access to claim information

- Increases the potential amount of Retro refunds

Remember: A costly claim can make your rates increase…the rates you pay on every single employee…not just the one injured employee. Control the claim costs with KOS.

Kept on Salary – Savings example

Many employers are concerned about the cost of KOS. It’s true that KOS can represent a bigger up-front expense with the goal of reducing long-term costs. Let’s take a look at the cost benefit of KOS: The following example is based on an actual claim in which the worker was off work and received time-loss payments for 45 days. However, the employer could have saved money by paying KOS vs allowing time-loss.

Here’s how:

|

L&I pays Time-Loss |

Employer pays Kept on Salary (KOS) |

| $168/day (65% of normal wage) | $280/day (100% of normal wage) |

| 45 calendar days (L&I pays every day of the week) =$7,560 | 30 business days (employer pays normal working days) =$8,400 |

| Employer’s account is charged 4.5 times the cost of time-loss =$7,560×4.5=$34,020 | Account is charged =$0 because no time-loss was issued |

| Actual medical cost =$9,000 | Actual medical cost =$9,000 |

| Reserve =$50,000 | Reserve =$0 because no time-loss was issued |

| Account will be charged at reserved amount for up to three years. |

Reduced charge to your account due to L&I’s “Medical Only Discount”. |

How do I pay Kept on Salary?

While Kept on Salary is essentially what it sounds like – continuing to pay the employee’s regular salary – here are a few important details and suggestions to keep in mind:

- The employer must pay 100% of wages from all employment, including any contribution to healthcare benefits that is normally paid to the employee

- If the employee has a second job (W2), KOS must reflect these wages as well, or the employee may be eligible for loss or earning power benefits.

- For seasonal or part-time employees, average 3 months’ pay to calculate KOS wages

- KOS must be paid directly by the employer. You cannot ask the employee to use vacation, sick leave, paid time off, etc. as KOS.

- Do not pay workers’ comp premiums on KOS – no work is being performed

- Consider turning off direct deposit when KOS begins and asking the employee to pick up his or her checks in person (if physically able).

- The employee should bring an updated Activity Prescription Form (APF) each time he or she arrives to pick up a check.

- KOS typically must be offered consistently to all injured workers who are certified as temporarily totally disabled. Employers cannot arbitrarily KOS one qualifying worker but not another. However, there are times when KOS is not advantageous or feasible. Your Retro Coordinator can help you determine if KOS is the right choice for a particular claim.

KOS is a bridge to facilitate light-duty return to work, so begin light-duty work as soon as the APF indicates a release to any type of work.

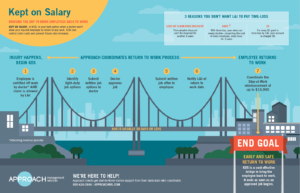

View our infographic on the Kept on Salary process!

Conclusion

The best way to control claim costs is to prevent injuries from happening in the first place. However, once an injury or occupational disease does occur, an employer’s ability to control costs is largely based upon the effectiveness of its return to work program and whether or not the employer utilizes KOS to mitigate claim costs.

In Washington State, the injured worker’s wages are the only workers’ comp benefit employers can pay. Approach and our clients credit much of their success over more than two decades to our return to work programs and KOS – we believe they are powerful tools that all employers should use to their advantage. These programs give employers greater control over their claims and provide long-term positive impacts on their experience modification rate (EMR) and retro refunds.

KOS represents a bigger up-front expense, but it reduces long-term costs for your company and provides stability for the worker. Your Approach Retro Coordinator can provide policy templates and guide you through implementation and analysis on specific claims.